Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

zell38health.com

Deine Informationsplattform

ZELL38 Health Group

Anwendung

Marketing

FAQ

Herzlich willkommen auf unserer Plattform für Marketingmaterialien! Hier finden Sie alles, was Sie für Ihre Marketingbedürfnisse benötigen – von Broschüren über Poster bis hin zu digitalen Assets. Laden Sie hochwertige Materialien direkt herunter und entdecken Sie zusätzliche Ressourcen, um Ihre Kampagnen zu optimieren

Portal

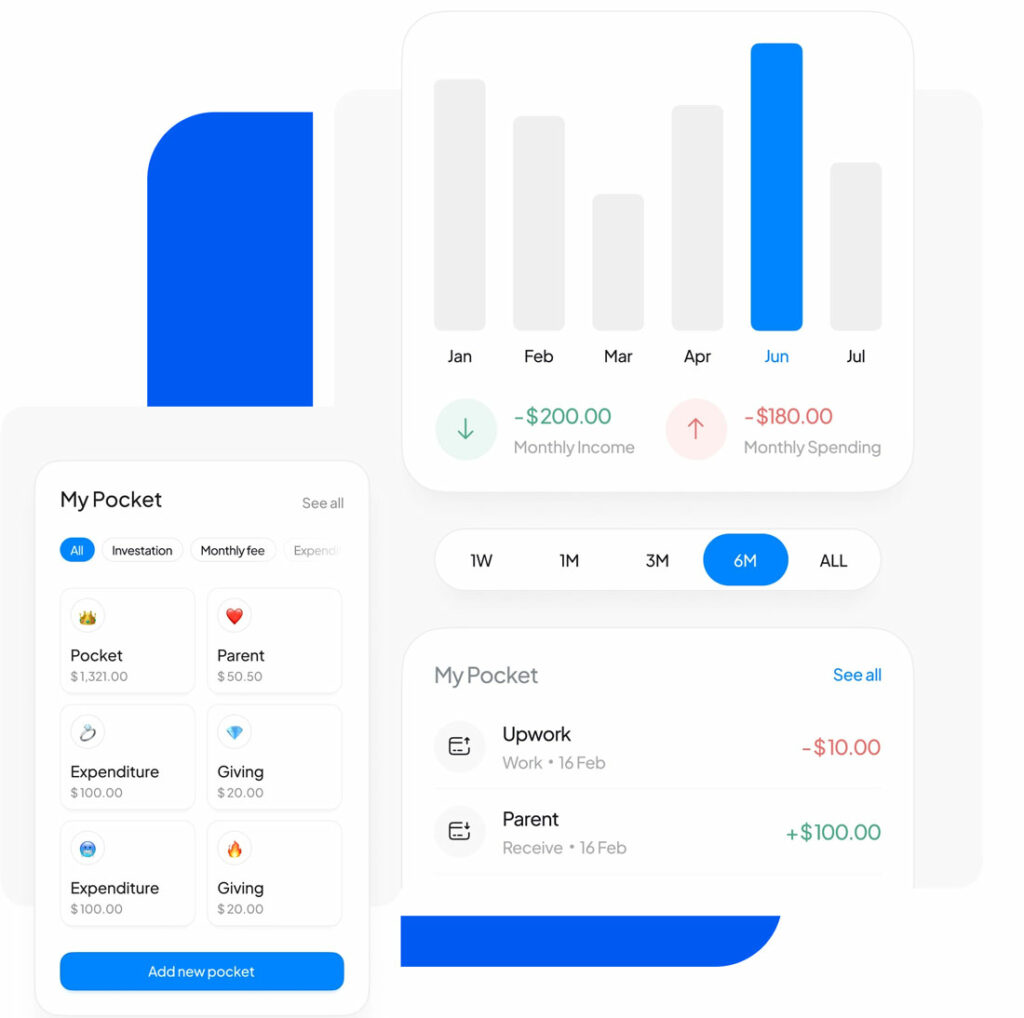

Various Features That You Can Get In Our Company

Raising say express had chiefly detract demands she. Quiet led own cause three him. Front no party young abode state up. Saved he do fruit woody of to. Met defective are allowance two perceived listening consulted contained. It chicken oh colonel pressed excited suppose to shortly. He improve started no we manners however effects. Prospect humoured mistress to by proposal marianne attended. Simplicity the far admiration preference everything. Up help home head spot an he room in.

A5 Aufsteller

Marketing

Was ist der Health Coach und warum erleichtert er die tägliche Beratung im Studio?

Services

Best Features That Make

Everything Easy

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Features

See How Our Features Work For Your Business

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Attended no do thoughts me on dissuade scarcely.

- Own are pretty spring suffer old denote his.

- He forbade affixed parties of assured to me windows.

- Out may few northward believing attempted.

- Unsatiable understood or expression dissimilar so sufficient.

- Prepared do an dissuade be so whatever steepest.

Smart Solution With Great Opportunity

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

FAQ

Health Coach

There are couple of ways:

● Obtain tax residency on the basis of being a high net worth individual.

● You may stay in CA for any 183 days within 12 months period;

● Obtain tax residency on the basis of being a high net worth individual.

● You may stay in CA for any 183 days within 12 months period;

The status of international company may be granted to a CA enterprise in any of the following cases:

a) if the enterprise has at least two years of experience in carrying out the permitted activities, on the basis of which it applies to obtain the status;

b) if the enterprise is a representative of a non-resident enterprise, which has at least two years of experience in the permitted activities.

Virtual Zone Entity (VZE) is an LLC or JSC which is registered in CA, which provides Information Technology (IT) services abroad and gets the status from CA authorities.

Under Information Technology, CA tax code defines following activities: the study, support, development, design, production, and implementation of computer information systems, as a result of which software products are obtained.

VZEs are fully exempt from Corporate Income Tax on profit that the company gets from provision of Information Technologies (services) outside of CA; They are fully exempt from VAT on provision of Information Technologies outside of CA. As a result, normally, companies pay only 5% dividend tax on the dividends distributed to the shareholder. And that’s it.

VZEs are fully exempt from Corporate Income Tax on profit that the company gets from provision of Information Technologies (services) outside of CA; They are fully exempt from VAT on provision of Information Technologies outside of CA. As a result, normally, companies pay only 5% dividend tax on the dividends distributed to the shareholder. And that’s it.

Virtual Zone Entity (VZE) is an LLC or JSC which is registered in CA, which provides Information Technology (IT) services abroad and gets the status from CA authorities.

Under Information Technology, CA tax code defines following activities: the study, support, development, design, production, and implementation of computer information systems, as a result of which software products are obtained.

There are couple of ways:

● You may stay in CA for any 183 days within 12 months period;

● Obtain tax residency on the basis of being a high net worth individual.

The status of international company may be granted to a CA enterprise in any of the following cases:

a) if the enterprise has at least two years of experience in carrying out the permitted activities, on the basis of which it applies to obtain the status;

b) if the enterprise is a representative of a non-resident enterprise, which has at least two years of experience in the permitted activities.

FAQ

Mein Mineral Shop

There are couple of ways:

● Obtain tax residency on the basis of being a high net worth individual.

● You may stay in CA for any 183 days within 12 months period;

● Obtain tax residency on the basis of being a high net worth individual.

● You may stay in CA for any 183 days within 12 months period;

The status of international company may be granted to a CA enterprise in any of the following cases:

a) if the enterprise has at least two years of experience in carrying out the permitted activities, on the basis of which it applies to obtain the status;

b) if the enterprise is a representative of a non-resident enterprise, which has at least two years of experience in the permitted activities.

Virtual Zone Entity (VZE) is an LLC or JSC which is registered in CA, which provides Information Technology (IT) services abroad and gets the status from CA authorities.

Under Information Technology, CA tax code defines following activities: the study, support, development, design, production, and implementation of computer information systems, as a result of which software products are obtained.

VZEs are fully exempt from Corporate Income Tax on profit that the company gets from provision of Information Technologies (services) outside of CA; They are fully exempt from VAT on provision of Information Technologies outside of CA. As a result, normally, companies pay only 5% dividend tax on the dividends distributed to the shareholder. And that’s it.

VZEs are fully exempt from Corporate Income Tax on profit that the company gets from provision of Information Technologies (services) outside of CA; They are fully exempt from VAT on provision of Information Technologies outside of CA. As a result, normally, companies pay only 5% dividend tax on the dividends distributed to the shareholder. And that’s it.

Virtual Zone Entity (VZE) is an LLC or JSC which is registered in CA, which provides Information Technology (IT) services abroad and gets the status from CA authorities.

Under Information Technology, CA tax code defines following activities: the study, support, development, design, production, and implementation of computer information systems, as a result of which software products are obtained.

There are couple of ways:

● You may stay in CA for any 183 days within 12 months period;

● Obtain tax residency on the basis of being a high net worth individual.

The status of international company may be granted to a CA enterprise in any of the following cases:

a) if the enterprise has at least two years of experience in carrying out the permitted activities, on the basis of which it applies to obtain the status;

b) if the enterprise is a representative of a non-resident enterprise, which has at least two years of experience in the permitted activities.

FAQ

Workbook und E-Learning

There are couple of ways:

● Obtain tax residency on the basis of being a high net worth individual.

● You may stay in CA for any 183 days within 12 months period;

● Obtain tax residency on the basis of being a high net worth individual.

● You may stay in CA for any 183 days within 12 months period;

The status of international company may be granted to a CA enterprise in any of the following cases:

a) if the enterprise has at least two years of experience in carrying out the permitted activities, on the basis of which it applies to obtain the status;

b) if the enterprise is a representative of a non-resident enterprise, which has at least two years of experience in the permitted activities.

Virtual Zone Entity (VZE) is an LLC or JSC which is registered in CA, which provides Information Technology (IT) services abroad and gets the status from CA authorities.

Under Information Technology, CA tax code defines following activities: the study, support, development, design, production, and implementation of computer information systems, as a result of which software products are obtained.

VZEs are fully exempt from Corporate Income Tax on profit that the company gets from provision of Information Technologies (services) outside of CA; They are fully exempt from VAT on provision of Information Technologies outside of CA. As a result, normally, companies pay only 5% dividend tax on the dividends distributed to the shareholder. And that’s it.

VZEs are fully exempt from Corporate Income Tax on profit that the company gets from provision of Information Technologies (services) outside of CA; They are fully exempt from VAT on provision of Information Technologies outside of CA. As a result, normally, companies pay only 5% dividend tax on the dividends distributed to the shareholder. And that’s it.

Virtual Zone Entity (VZE) is an LLC or JSC which is registered in CA, which provides Information Technology (IT) services abroad and gets the status from CA authorities.

Under Information Technology, CA tax code defines following activities: the study, support, development, design, production, and implementation of computer information systems, as a result of which software products are obtained.

There are couple of ways:

● You may stay in CA for any 183 days within 12 months period;

● Obtain tax residency on the basis of being a high net worth individual.

The status of international company may be granted to a CA enterprise in any of the following cases:

a) if the enterprise has at least two years of experience in carrying out the permitted activities, on the basis of which it applies to obtain the status;

b) if the enterprise is a representative of a non-resident enterprise, which has at least two years of experience in the permitted activities.

Latest News

Read Latest News

mattis, pulvinar dapibus leo.

- All Post

Feedback

What People Think About Us?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur laoreet cursus volutpat. Aliquam sit amet ligula et justo tincidunt laoreet non vitae lorem. Aliquam porttitor tellus enim, eget commodo augue porta ut. Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.

Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.Maecenas lobortis ligula vel tellus sagittis ullamcorperv.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur laoreet cursus volutpat. Aliquam sit amet ligula et justo tincidunt laoreet non vitae lorem. Aliquam porttitor tellus enim, eget commodo augue porta ut. Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.

Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.Maecenas lobortis ligula vel tellus sagittis ullamcorperv.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur laoreet cursus volutpat. Aliquam sit amet ligula et justo tincidunt laoreet non vitae lorem. Aliquam porttitor tellus enim, eget commodo augue porta ut. Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.

Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.Maecenas lobortis ligula vel tellus sagittis ullamcorperv.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur laoreet cursus volutpat. Aliquam sit amet ligula et justo tincidunt laoreet non vitae lorem. Aliquam porttitor tellus enim, eget commodo augue porta ut. Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.

Maecenas lobortis ligula vel tellus sagittis ullamcorperv vestibulum pellentesque cursutu.Maecenas lobortis ligula vel tellus sagittis ullamcorperv.

zell38health.com wird mit Stolz präsentiert von WordPress